"I worry about people getting worn out from taxes"

COLUMBIA, Mo 12/14/15 (Beat Byte) -- With over $125 million in the bank, the Columbia Public School (CPS) district is planning one of the largest property tax hikes in recent memory.

School Board members at tonight's meeting will consider putting the increase before voters in April.

The 65 cent/$100 of property value tax hike is 11 cents more than a 54 cent hike voters rejected in 2008, prompting the resignation of then-Superintendent Phyllis Chase.

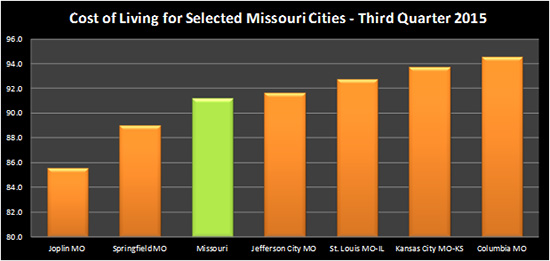

Recently named Missouri's highest cost of living city, Columbia has seen dozens of tax, rate, and fee hikes, for everything from mental health care to 911 services to infrastructure repair, most in the last 5-7 years.

Much of the money raised, however, ends up in local banks. CPS has nearly doubled its cash on deposit, from $65 million in 2001 to $125.2 million last year (Source: 2000-2014 CPS CAFR).

The pocketbook barrage has prompted greater-than-usual skepticism, which School Board Members Darin Preis and Christine King reflected last week.

"I worry about people getting worn out from taxes," Preis told reporters. "It's a big ask," King added.

The levy increase comes after district officials -- and voters -- approved similar hikes every year for the past seven years.

Each August, School Board Members are legally allowed to vote for smaller increases. And every two years, they make big asks at the polls. Rents and housing costs have soared in the meantime.

One year after the 2008 levy defeat, the Columbia School Board hiked property taxes by 4.25 cents/$100 assessed valuation.

The next year, Board members approved a 14.75-cent tax hike.

Another 3.2 cent tax hike followed in 2011, as Board Members mulled a larger, voter-approved increase on the 2012 ballot: 60 cents.

Voters said "yes" to a pared down 40 cent tax hike in April 2012 and $50 million in new bond debt.

"Property owners will see more of their money going to Columbia Public Schools," the Columbia Daily Tribune reported the following August, when Board members approved another 12 cent boost.

"The Columbia Board of Education voted to again raise the amount property owners will pay to the district," this time by 2.2 cents/$100 valuation, the Tribune reported in 2013.

In 2014, the School Board approved yet another tax hike: 6.29 cents/$100 valuation.

The seven tax increases in seven years added a whopping 82.7 cents/$100 valuation to district coffers. Renters are getting socked too, paying much higher rents than they did in 2008, despite the housing bust and an oversupply of rental properties.

CPS also voted for someone else's tax hike: the controversial Business Loop CID, which required approval from local government agencies to raise taxes on groceries and other items. "We are going to greatly benefit from this," Board Member Jonathan Sessions told the Tribune. The new CID taxes will improve the area, Sessions added, which "needs a little love."